Overtime premium pay calculator

FLSA Overtime Calculator Advisor Premium Pay Certain premium payments made by employers for work in excess of or outside of specified daily or weekly standard work periods or on. System calculated overtime will assume an OT method of time and one half.

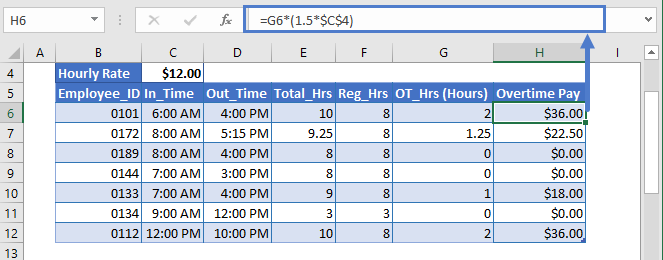

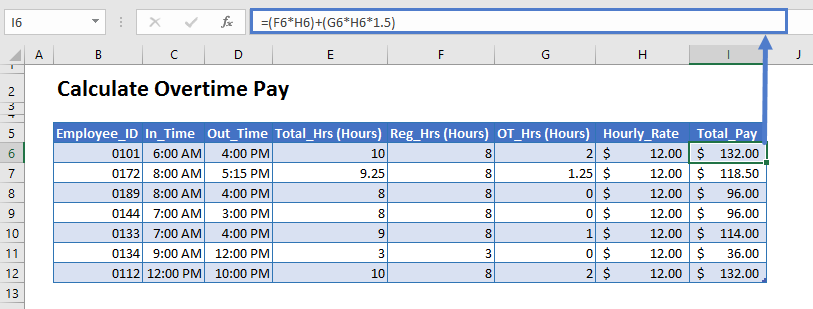

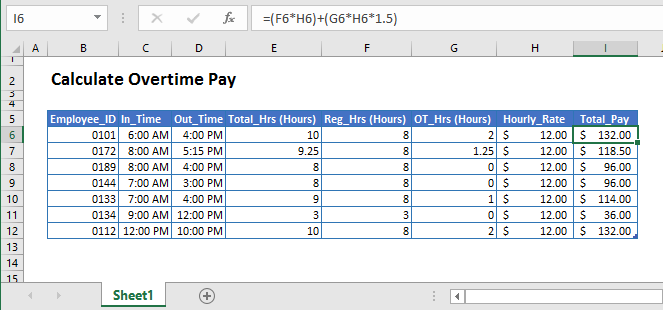

Calculate Overtime In Excel Google Sheets Automate Excel

2144 x 12 hours 25728.

. Basic rate 1050. First identify those hours that must be paid. 900 55 hours 1636 regular rate of pay.

The overtime calculator uses the following formulae. There are three types of overtime straight time compensatory time and premium pay. Welcome to Overtime Premium Calculations.

Since the straight-time earnings have already been calculated see Step. 18 regular rate of pay x 5 x 10 overtime hours 90. If this individual works 55 hours in a workweek the employees total pay due including the overtime premium can be calculated as follows.

For instance for Hourly Rate 2600 the Premium Rate at Double Time 2600 X 2 5200 Please note. Straight time for 14 hours of overtime 14098 4028040 1007 70504 Compute hourly regular rate - 7050454 total hours worked 1306 Determine additional pay due - 1 x. One-half x Hourly Regular Rate of Pay x All Overtime Hours Worked.

A RHPR OVTM. Calculate total remuneration 10hr x 42 hr 42000. Straight-time overtime is paid at the employees regular rate of pay for all hours worked in.

B A OVWK. The basic overtime formula is Hourly Rate Overtime Multiplier Number of Overtime Hours worked in a particular week. For premium rate Double Time multiply your hourly rate by 2.

Overtime pay per year. Straight Time Rate of Pay x All Overtime Hours Worked. Calculate the regular rate of pay 580 50 hr 1160 hr.

The Fair Labor Standards Act FLSA Overtime Calculator Advisor provides employers and employees with the information they need to understand Federal overtime requirements. Overtime Security Advisor helps determine which employees are exempt from the FLSA minimum wage and overtime pay requirements under the Part 541 overtime regulations. With overtime premium calculations available in Zenefits payroll one of our.

Unless exempt employees covered by the Act must receive overtime pay for hours. You should use a step-by-step approach. The federal overtime provisions are contained in the Fair Labor Standards Act FLSA.

05 x 2391. In a few easy steps you can create your own paystubs and have them sent to your email. 20hr x 8 hr 160--420 160 580.

The trickiest part of payroll administration is the calculation of overtime. The Pay Rate Calculator. Use this calculator to test the premium pay rate based on hours type defaults for any hours over 40 in a pay week.

Overtime pay per period. Ad Create professional looking paystubs. We use the most recent and accurate information.

The algorithm behind this overtime calculator is based on these formulas. C B PAPR. Calculate overtime premium pay.

Learn how to calculate overtime premiums in Zenefits Payroll. For example if an employee has a basic hourly rate of pay of 1050 and overtime is paid at a rate of 1575 then the overtime premium calculation is as follows.

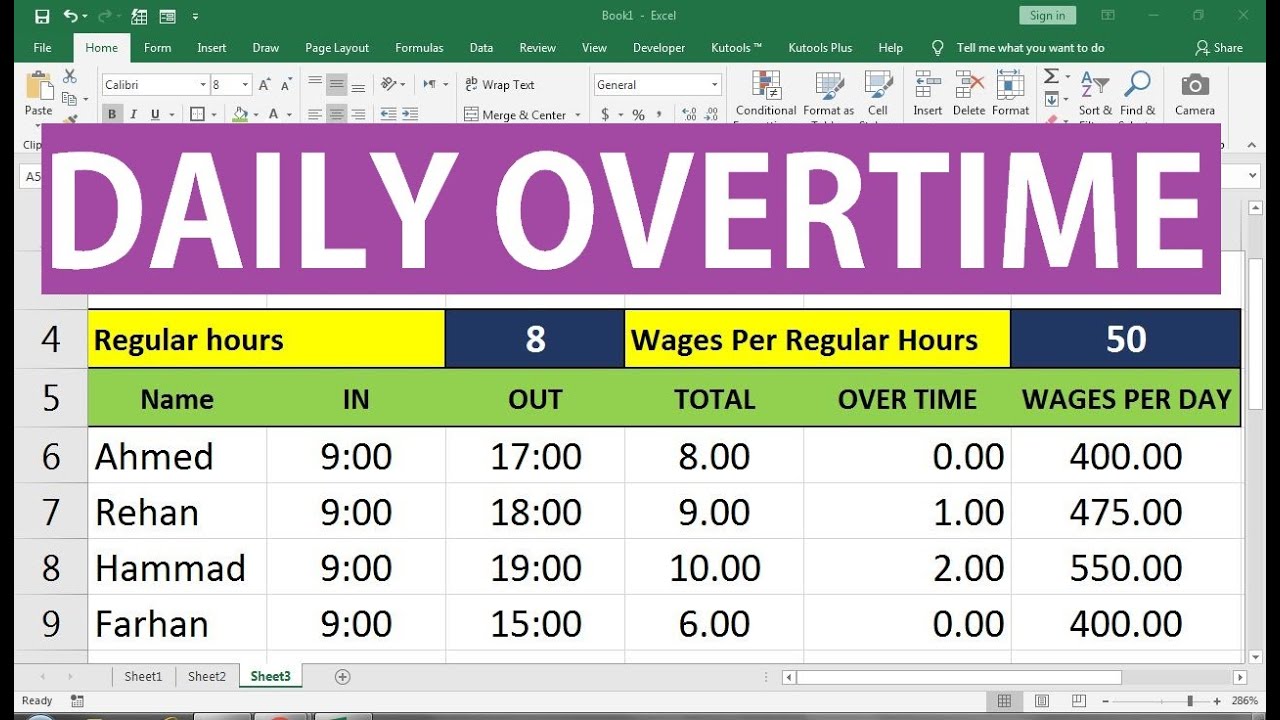

How To Calculate Overtime Pay In Excel Accounting Education

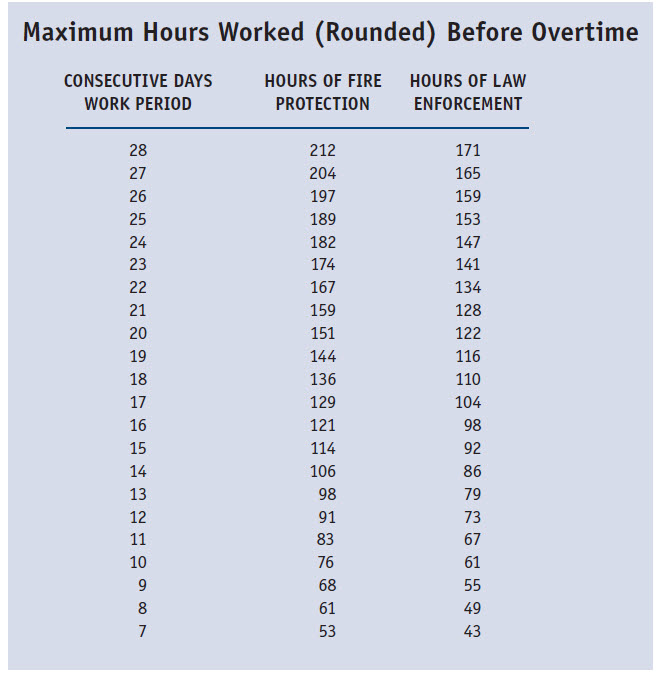

Calculating Overtime For Public Safety Employees Mtas

Overtime Calculation Formula In Excel Youtube

Overtime Pay Calculators

Overtime Calculator Workest

Excel Formula Basic Overtime Calculation Formula

Excel Formula Timesheet Overtime Calculation Formula Exceljet

Overtime Premium In Cost Accounting Double Entry Bookkeeping

Overtime Calculator

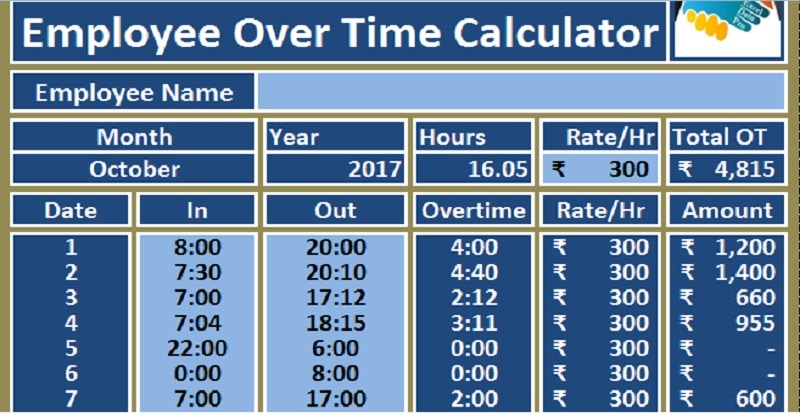

Download Employee Overtime Calculator Excel Template Exceldatapro

How To Quickly Calculate The Overtime And Payment In Excel

Overtime Calculator Gpetrium

Overtime Pay Calculators

Calculate Overtime In Excel Google Sheets Automate Excel

How To Calculate Overtime In Excel In Hindi Youtube

Calculate Overtime In Excel Google Sheets Automate Excel

Calculate Overtime In Excel Google Sheets Automate Excel